Colorado’s electricity rates continue to rise

- September 16, 2017

Executive Summary

In 2001, Colorado electricity consumers enjoyed some of the lowest

electric rates in the country. The 15 years since haven’t been so kind

to ratepayers. For more than a decade, elected officials, PUC

commissioners, industry and advocates have told Colorado ratepayers that

they could transform the state’s electricity generation away from coal

and toward industrial wind, solar and natural gas with little cost to

ratepayers. However, the actual numbers tell a much different story.

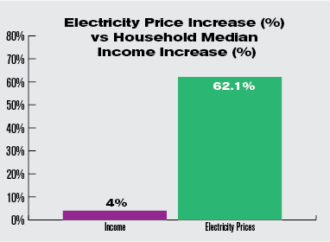

- Colorado electricity rates have risen sharply – 62.1 percent –

across residential, commercial and industrial sectors, despite a slight

decrease in recent years. - Colorado electricity rates have increased 17.2 percentage points

more than the Mountain state region (Arizona, Idaho, Montana, New

Mexico, Nevada, Utah and Wyoming) collectively, where rates increased

44.9 percent over the same time period. - The 62.1 percent increase is 1.75 times more than the cumulative rate of inflation at 35.4 percent.

- The rise in electricity rates has outpaced the rise in household

income which has averaged a meager four percent over the last 10 years. - Public policy may be to blame in part. Colorado Public Utilities

Commission (PUC) data suggests that in 2012, part of the dramatic

increase was due to the renewable energy mandate.

Since 2001, Centennial state ratepayers have been forced to endure a

62.1 percent electricity rate hike across all sectors. What happened in

those 15 years?

The New Energy Economy (NEE),

ushered in by one-term Democrat Governor Bill Ritter (2007-2010) and

advanced by current Democrat Governor John Hickenlooper, is a spate of

nearly 57 laws that transformed how the state generates and delivers

power. Included in the NEE are mandates and programs such as 30 percent

renewable energy standard, tripling of the original 10 percent mandate

passed by voters in 2004; mandated fuel switching from coal to natural

gas titled the “Clean Air, Clean Jobs Act,” and Demand-side management, where customers pay monopoly utilities not to produce electricity.

Following up on a March 2016

paper from then senior energy policy analyst Michael Sandoval, our

current analysis shows a slight decline in recent years but still an

overall trend of skyrocketing rates. We looked at each sector over the

last 15 years and compared Colorado to other Mountain states and the impact on ratepayers.

Rising Electricity Rates

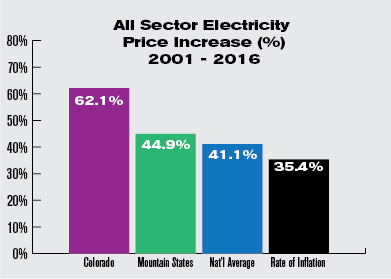

Data analysis shows that electricity rates across all sectors

(residential, commercial, and industrial) increased by an average of

62.1 percent between 2001 and 2016. For context, the average increase

across all sectors for all Mountain states during the same period was

44.9 percent. The increase nationally was 41.1 percent. Colorado saw

increases that were 17.2 and 21 percentage points higher than the

mountain states and the United States respectively.

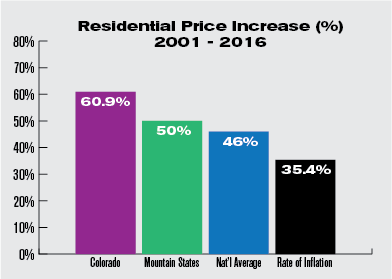

Colorado’s residential rates haven’t fared much better, increasing

60.9 percent over the last 15 years. While this increase isn’t the

highest among Mountain states, it is nearly 11 percentage points higher

than the collective 50 percent increase over the same time period, and

14.9 points higher than the U.S. average of 46 percent.

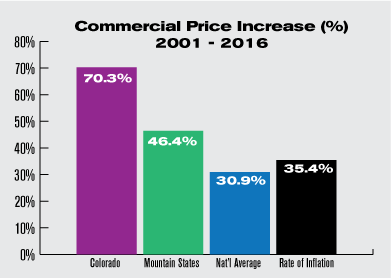

The rise in Colorado’s commercial

electricity rates (usually defined as a smaller manufacturer or

activity that produces a service) was an alarming 70.3 percent over the

last 15 years. While the average across Mountain states was 46.4 percent

and the U.S. average was 30.9 percent. Colorado’s increase is 23.6

percent more than its region and more than double the U.S. average.

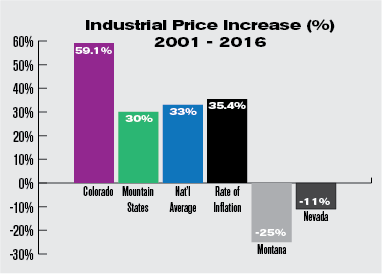

Colorado’s industrial

rates (saved for larger industrial and commercial users) tell a similar

tale having increased by 59.1 percent over the last 15 years. The

Mountain state average during this same period has been 30 percent with

the U.S. average approximately 33 percent. Again, Colorado’s rates have

far outpaced the U.S. and Mountain state average considerably. As

Colorado rates have risen, some states have seen a decline in particular

Montana and Nevada rates have dropped by 25 and 11 percent

respectively.

Across all sectors there was a marginal decrease in the cost of

electricity between 2014 and 2016 of 0.30 cents per kilowatt hour or

approximately 9 percent. This coincides with a decrease in the energy price index of 10.1 percent, which typically results in lower fuel costs for utilities and a lower cost of living for consumers.

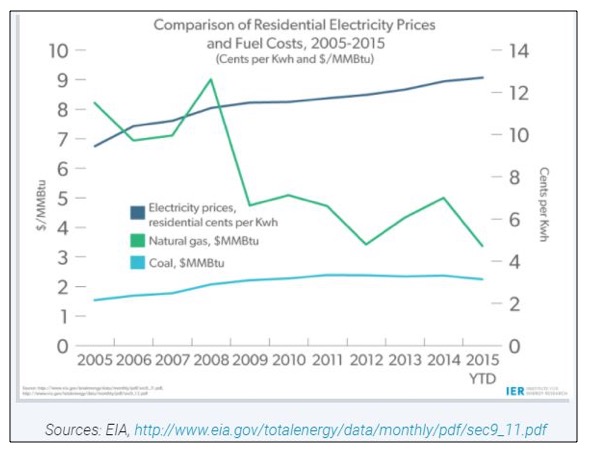

A key factor in the decrease of the energy price index was the price of

natural gas as the Institute for Energy Research reported:

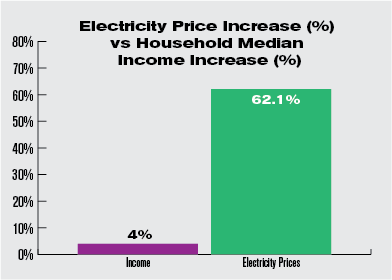

Between 2005 and October of 2015… natural gas prices delivered to electric utilities declined by almost 60 percent and coal prices have remained essentially flat.Still, that decrease didn’t come close to narrowing the gap between

the rise in Colorado electricity rates and median household income. In

2005 Colorado’s household

median income was $61,474, by 2015 this amount was only $63,909, an

increase of only 4 percent. This disparity between income and the cost

of electricity is shown more clearly in the graph below.

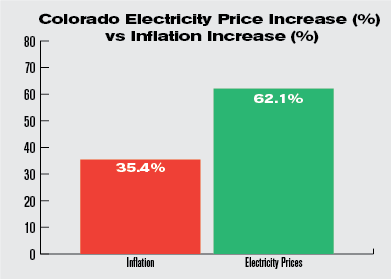

During this same time, U.S. cumulative inflation

rate was 35.4 percent. That means the cost of powering Coloradans’

homes and the state’s economy has increased 1.75 times (nearly double)

the rate of inflation as the graph below illustrates. That electricity

prices have risen is no surprise, that the price has risen by 57 percent

more than inflation is surprising.

The Why

We know from previous research that Colorado’s electric generation capacity is plentiful, in fact, Colorado has excess generation. With excess supply, what are rates low? The simple answer is public policy.

Governor Bill Ritter assured Coloradans that tripling the renewable mandate wouldn’t increase costs to consumers. Yet the Institute for Energy Research (IER) notes:

Colorado has higher electricity rates than most ofAdditionally, IER in their study ‘The escalating cost of electricity’ explain the impact of regulations and mandates on Colorado rates:

its neighboring states: Colorado jumped from middle of the pack to

second highest residential electricity prices in the Mountain West since

the RPS was implemented. Additionally, Colorado Public Utilities

Commission data show that the RPS was directly responsible for a 13

percent increase in Colorado’s electricity rates in 2012.

Over the past 10 years, electricity prices have been

going up, while over most of that time, the costs of coal and natural

gas—the two major fuel inputs to electric generation—have declined or

stayed relatively flat. This anomaly is caused by the growth of more

expensive renewable energy (wind and solar power) and the onerous

regulations that the Environmental Protection Agency (EPA) is forcing on

electric utilities that require capital investments to be made to

existing generators. This trend has occurred at both the national level

and in states like Colorado, and has happened when U.S. electricity

consumption has stayed relatively flat or even declined.

Impact on consumers

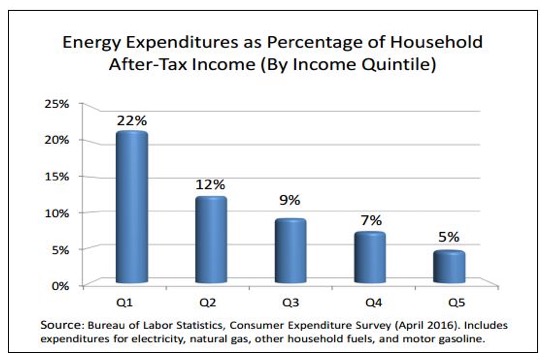

According to the American Coalition for Clean Coal Electricity (ACCCE) “In the U.S., energy costs eat between 5 and 22 percent of families’ total after-tax income, with the poorest Americans, or 25 million households, paying the highest of that range.”

Those in Quintile one (Q1) i.e. the poorest households on average

spend 22 percent of their after-tax income on energy. The study found

that increases in the cost of electricity disproportionately affect

those in Q1. Their energy needs are generally inflexible therefore any

increase in the cost of electricity means they must reduce spending in

other basic necessities such as food and clothing.

In contrast, the U.S. average for household expenditure on energy is

seven percent of after tax income. It is fair to say that the

electricity price increases in Colorado have taken money from

ratepayer’s pockets. ACCCE goes as far as saying these increases “…serve as an effective tax on households.“

Even Xcel acknowledges the challenge of high electricity rates on low income Coloradans and provides payment options for them.

Xcel, the state’s largest electricity utility, calculates monthly payments based on 3 percent of a household’s income.Bottom line, Colorado’s public policy that has driven up electricity rates hurts the least among us.

Average households pay 2 percent to 3 percent for energy,

compared with low-income households, which often pay as much as 50

percent.

‘That leaves very little for food, clothing, medicine,’ said Pat Boland, Xcel’s manager of customer policy and assistance.

Conclusion

Governor Ritter and other renewable energy advocates said the NEE in

Colorado wouldn’t cost ratepayers more. A 62.1 percent electricity

increase, over the last fifteen years, across all sectors, shows just

how wrong they were. Over the same period, the price of natural gas has dropped an astonishing 79.3 percent, while the price of coal

rose marginally by 0.6 percent. Ratepayers have not benefitted from the

drop in prices and instead have had to contend with rising electricity

prices.

The rise in prices has hurt low income families disproportionately,

with most of their income being redirected from basic necessities to

paying for power. At the same time, household median incomes across the

state have barely risen. The legislative mandates imposed by the NEE

have played a major role in the rise in prices. This begs the question,

would Coloradans have supported the NEE had they known the cost upfront?

What is clear: ratepayers are the biggest losers when prices increase so drastically while incomes remain static.